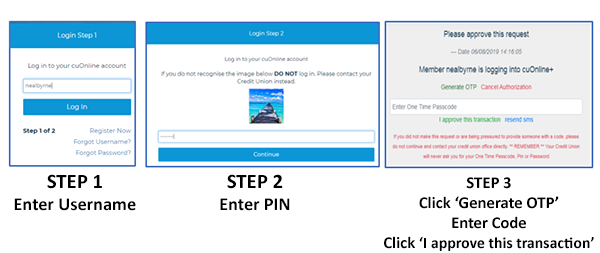

The Payment Services Directive (PSD2) is a new law within the European Union which gives you greater control over your data, enhances transparency and will further protect your banking and purchases online.

Payment Services Directive (PSD2) will come into effect from September 14th.